Everywhere you look, you’ll see people promoting the Chase Ultimate Rewards program and points transfers to Hyatt. The love for Hyatt in the blogosphere seems unlimited, even though they have repeatedly devalued their loyalty program just like everyone else (both covertly, by raising the category of existing properties, and overtly, by shifting to a multi-tiered pricing model). Sure, Hyatt has some nice properties, but the majority of them are mediocre properties (many of which in the US are owned by the notoriously cheap operator Aimbridge Hospitality). Many of them don’t even clean your room. So the reality of Hyatt is that you’re paying higher prices for worse service, so it’s worth questioning the comparatively higher cash rates that they charge versus other properties. And this should factor into your calculations when spending points. Even if you’re spending points at a high return, if that return is up against a poor cash value, this isn’t a good use of points!

This brings up the hotel program that almost nobody talks about: Choice Privileges. I get it: the program is obscure. And yes, very few people would consider a Comfort Inn to be an aspirational property. Nevertheless, these are the exact kinds of properties that I spend actual cash on, and the cash prices are actually competitive. When I’m traveling, I am usually just looking for a clean comfortable room where I can get a good night’s sleep without breaking the bank.

Here’s an example. The Comfort Hotel Tokyo Kanda costs 8,000 Choice Privileges points per night. That’s up against a JPY 17,700 rate on the weekends, which is $118.49. The property is just a 7 minute walk to Akihabara, which is one of my favorite neighborhoods in Tokyo. So if you were transferring points at 1:1, it’d be just shy of 1.5 cents per point which is a completely reasonable points redemption. It’s well above the Seat 31B weighted average realistic value of most points programs.

However, Citi ThankYou points transfer 1:2 to Choice Privileges, meaning that you’re paying just 4,000 Citi points per night. This yields a return just shy of 3 cents per point, and this isn’t some pie-in-the-sky valuation against cash you’d never actually spend. It’s close to 3 cents per point in value against a totally reasonable cash price that I’d be spending in Tokyo anyway, if not at this property, at another similar business hotel.

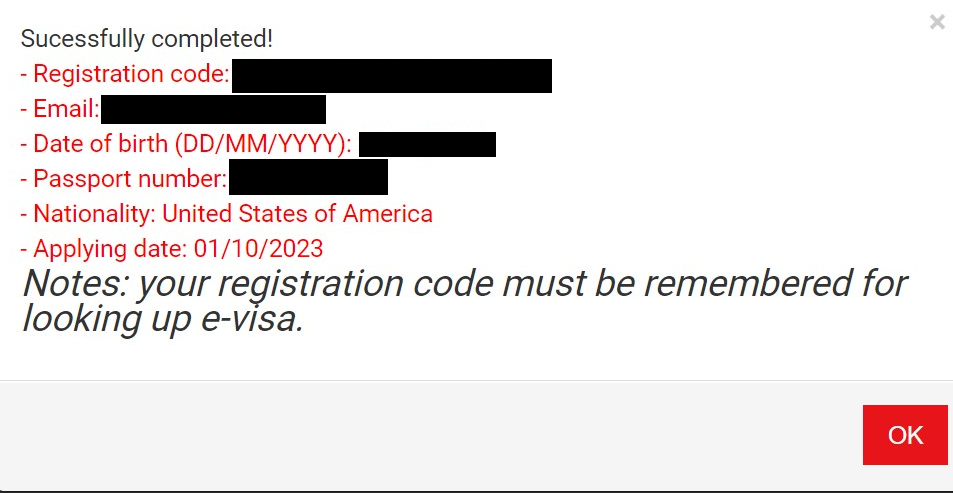

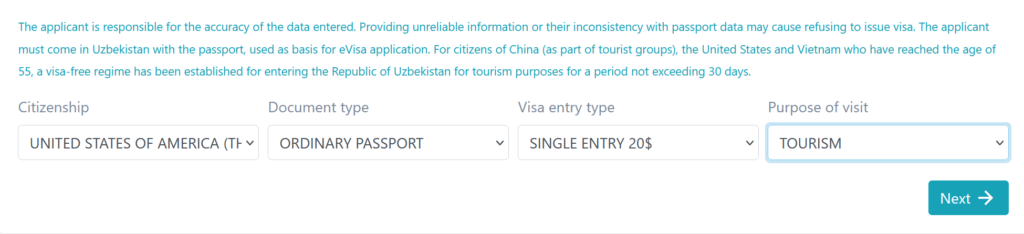

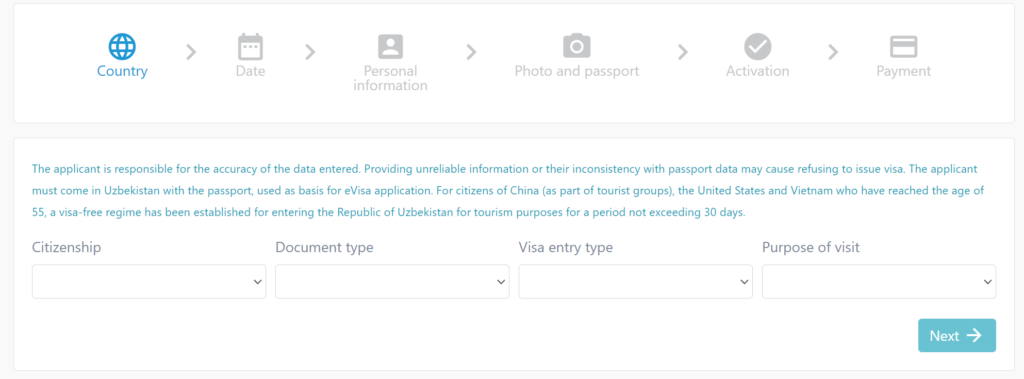

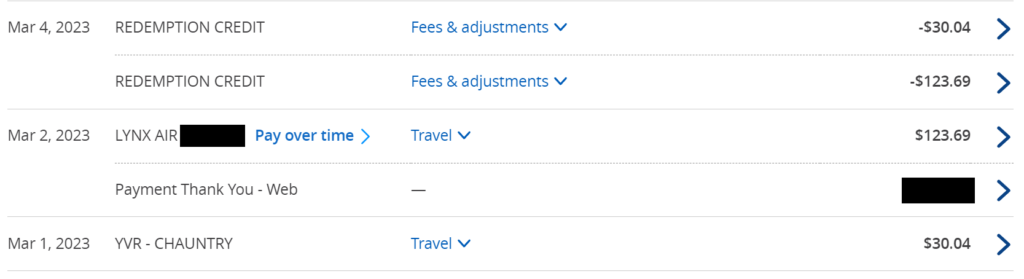

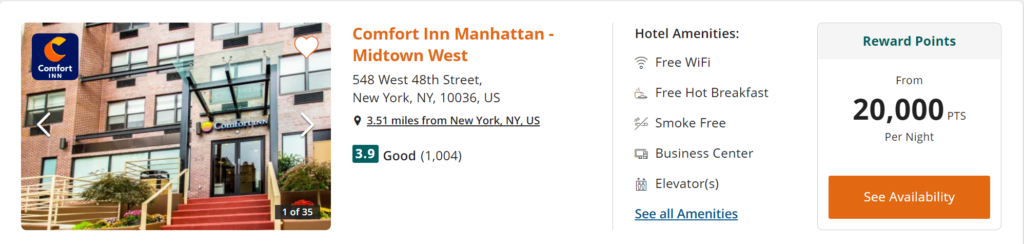

The value can be even greater than this. Take New Year’s Eve in New York. The Comfort Inn Manhattan-Midtown West is $540 per night all-in, cash rate:

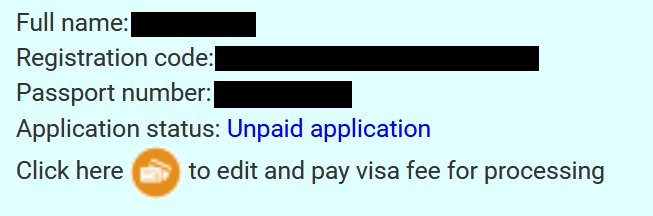

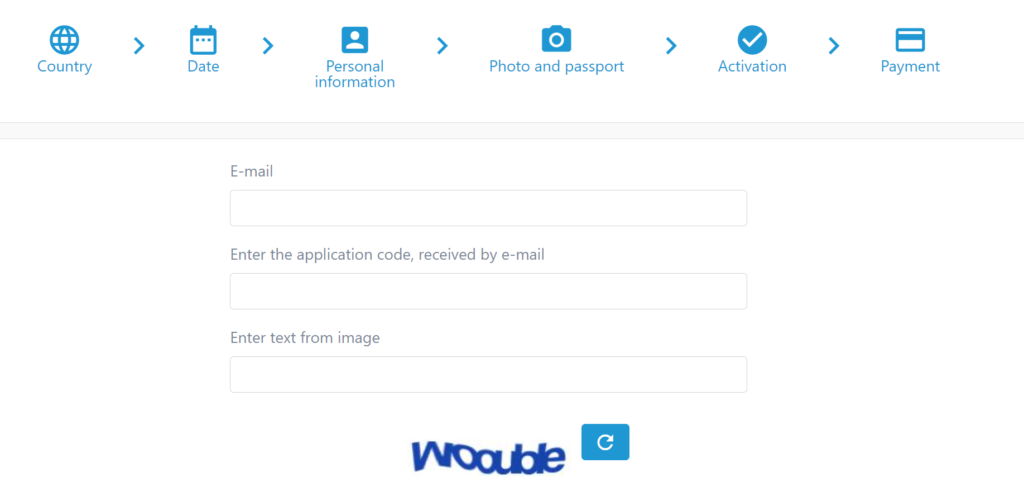

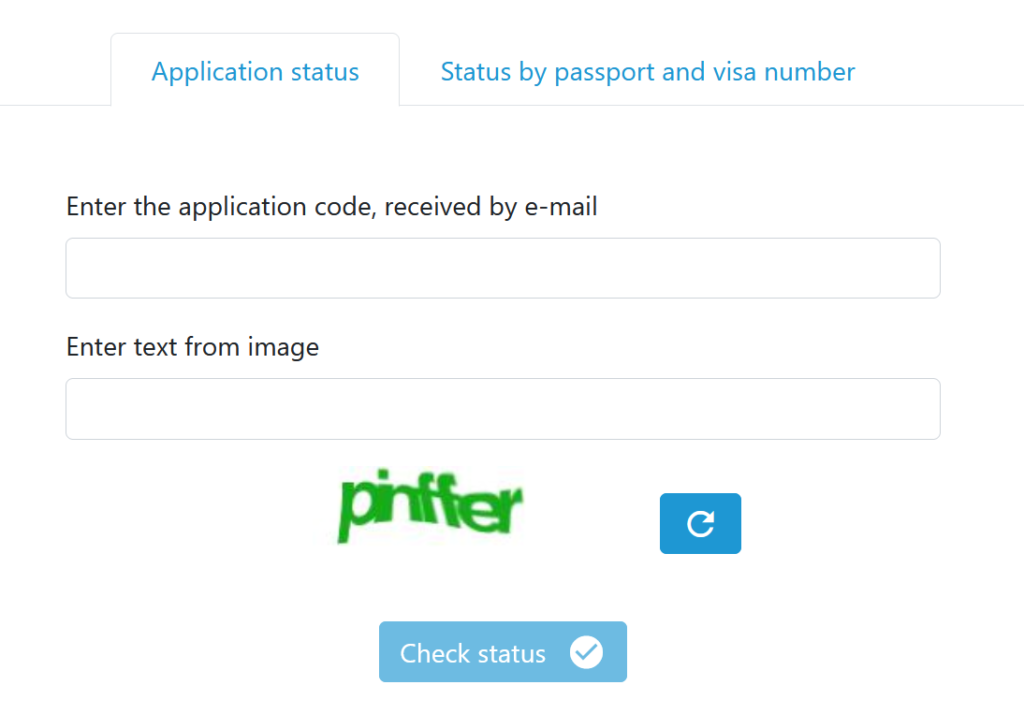

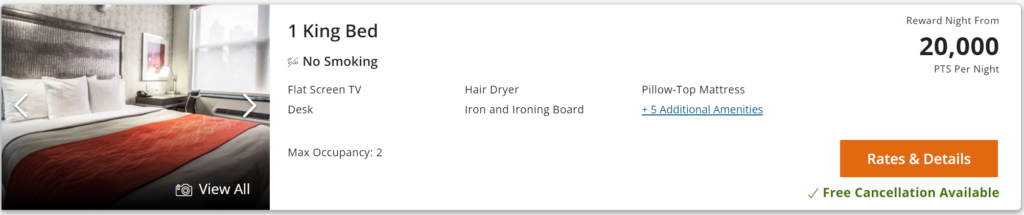

If you’re paying with points, it’s 20,000 Choice Privileges points, or 10,000 Citi ThankYou points:

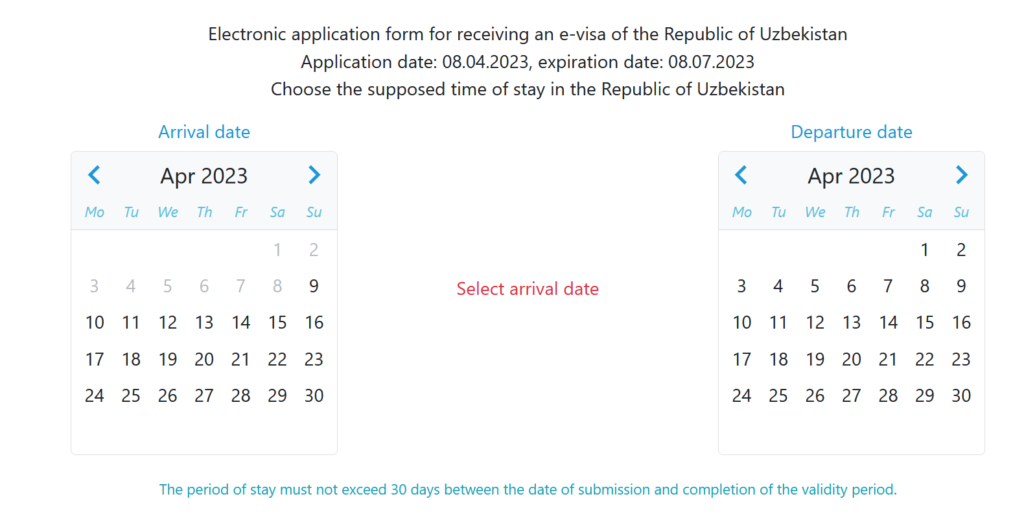

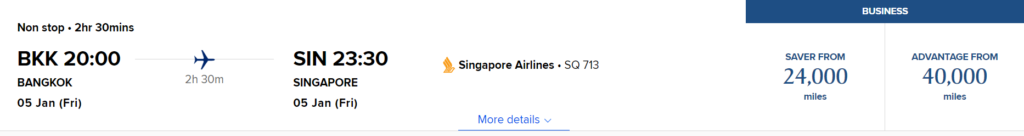

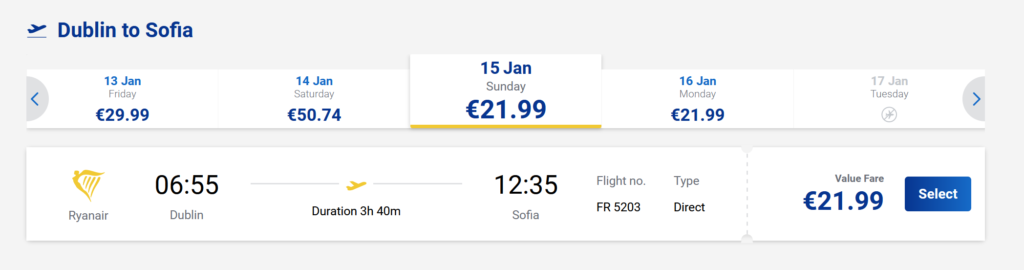

This isn’t just for the weird room every hotel on Manhattan seems to have. You know the one; it used to be a closet next to the elevator, and someone crammed a twin bed in there. You have your choice of two twin beds, a queen bed, or this swank king room:

This is a normal rate for New Year’s Eve in New York. It’s a completely reasonable property on Manhattan. And reserving through Choice Privileges delivers an absolutely astonishing 5.4 cents per point in value for your Citi ThankYou points. By the way, this inventory is live right now. You can go out and book it. If you go, send me pictures of the ball dropping in Times Square.

Now, I get it. Citi doesn’t pay fat commissions to bloggers like Chase does, so their cards are promoted less. Citi also has fewer cards in their ThankYou Rewards program, so it’s harder to churn through signup bonuses: you actually have to spend on their cards to earn ThankYou points. For the most part, there aren’t fancy splashy high annual fee cards in the program; in fact, Citi probably wins the “fewest perks” award for their card lineup (they don’t even offer secondary rental car insurance). So this program, in all likelihood, gets less attention than other programs.

Choice also doesn’t have fancy aspirational properties (their Ascend Collection brand, which are Choice’s highest end properties, are upper midrange at best). If you’re the kind of person who is excited more by the hotel where you’re staying than the destination you’re in, this program is probably not for you. You also can’t reserve more than 3 months in advance, so if you’re planning well in advance, it can be hard to use this program. Choice seems to manage their program to give away the rooms they don’t think they’ll sell, with an availability floor for rooms booked with points.

If you’re going to stay in a mediocre property anyway, wouldn’t you rather pay a price to match? Skip overpriced and dumpy Hyatt properties and consider a Choice or Wyndham hotel instead.