Chase issues a cobranded credit card with Air Canada Aeroplan. It has a very interesting feature called Pay Yourself Back. This card isn’t especially popular in the US, but I have gotten pretty good value out of it over the past year. Although I live 900 meters inside the US, my home airport is Vancouver. Being a cardholder allows a free checked bag, even on basic economy fares. The card is also a MasterCard, which can give better exchange rates in Canada (where I usually shop) than Visa, and most importantly is accepted at Costco where only MasterCard is accepted in Canada. In a typical year I’ll break even on bag fees alone by holding the card, but this card has a very interesting feature that has become the primary way that I redeemed Ultimate Rewards points this year.

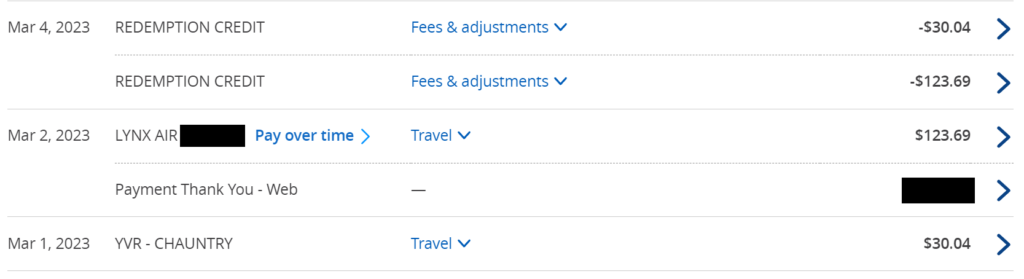

Chase has a “Pay Yourself Back” feature on their Ultimate Rewards cards that allows you to request statement credits at a fixed value for point redemption in particular categories. They also offer this feature with the Aeroplan card, in which you can redeem Aeroplan points against any purchase categorized as travel at 1.25 cents per point. On its own, this doesn’t seem like all that great of a deal until you factor in stacking transfer bonuses. For every 50,000 points you transfer to Aeroplan from Chase Ultimate Rewards, Chase gives a 10% transfer bonus when holding the card. They have also offered 20-30% transfer bonuses throughout the year, and these stack with the transfer bonuses. I have taken full advantage of these opportunities to transfer Ultimate Rewards points, meaning that I have effectively gotten 1.625 cents per point in redemption value from Ultimate Rewards when using Pay Yourself Back.

Now, this may not sound all that exciting. “1.625 cents per point?” you may ask. “I can get 10 cents per point in value when redeeming for Emirates first class!” And yes, this is theoretically true, but this is Seat 31B you’re reading, not some fancy blog. Over here, we try to spend points on things that we’d have actually bought with cash, and when you view things in that light, 1.625 cents per point is really good.

Some cards come close. You can get 1.5 cents per point in value for Ultimate Rewards when carrying the Chase Sapphire Reserve and redeeming through the Chase travel portal. The problem with that is that you have to carry a card that doesn’t offer any airline benefits and has an effective $250 annual fee. You also have to book through the Chase portal, and the pricing tends to be higher than through other sources. So, using Aeroplan Pay Yourself Back, I have been able to book the cheapest flights (often, ironically, on Air Canada’s largest competitor WestJet) and independent hotels (which I generally prefer anyway vs. chain hotels–you might be shocked to learn that hotels other than Hyatt properties exist). I have redeemed hundreds of thousands of my Chase points this year this way, on travel that I would have otherwise bought with cash. To me, that’s huge. So early this month, when all of this stopped working, it was a major annoyance.

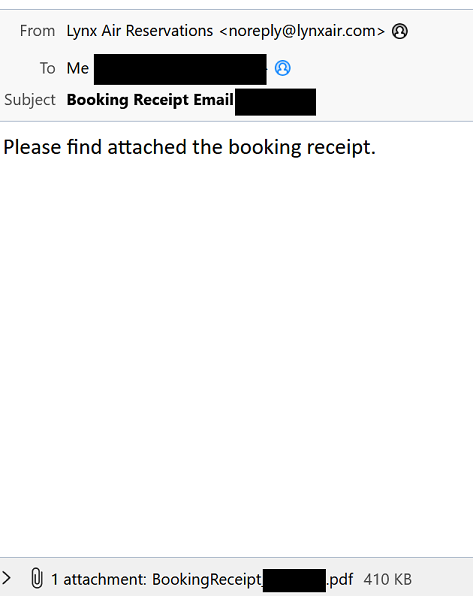

I logged onto the Chase Web site as I normally do, and tried to use Pay Yourself Back to reimburse a purchase as I often did. I filled in the amounts, clicked through to approve the transaction and… nothing. I’d just be thrown back to the homepage on the Chase Aeroplan Web site. So, I called Chase. One agent told me to wait a day and try again. Another agent tried to reproduce the problem on their end, and they could, but failed to escalate properly. Another agent filed a ticket, but nothing happened. Another agent filed a different ticket, where again nothing happened, and I was told to call back in a week. Finally, I got sick of the runaround and stopped in at a Chase branch today. They couldn’t solve the problem either, but did inform me that under no circumstances would they waive the annual fee despite the issues I was actively experiencing.

Finally, I called Aeroplan today for something entirely different. The 2FA settings weren’t working correctly on my account and I wasn’t sure why. The friendly agent informed me that my account was locked. I bought a new computer a couple of months ago and apparently, this completely freaked out Aeroplan’s security software which locked my account for no good reason, with no obvious notification that it had happened. She validated my account by asking a bunch of questions and then did whatever Aeroplan does on their end to unlock my account, which eventually worked. She also helped me sort out the 2FA problem, despite working overtime and needing to pick up her kid. So kudos to Aeroplan for at least helping to acknowledge and fix the problem they caused, versus Chase for its abject failure to communicate.

I was finally able to complete my Chase Pay Yourself Back transaction. Yay! So, if you’re having the same problem, check on the Aeroplan side whether your Aeroplan account is locked. The only indication that there is an issue is if you’re trying to redeem points directly in the Aeroplan program, in which case you’ll be prompted to contact Aeroplan’s call centre. You won’t see an indication of issues with your account otherwise because you can still search and buy flights, earn points, and fly Air Canada as normal. And there is no sensible error message on the Chase side; you just get thrown to a random section of their Web site.

I’ll just let things play out on the Chase side and see what happens. The issue no longer reproduces so I am expecting the ticket to be closed without Chase doing or fixing anything, or notifying me. They can probably stop sending me advertisements for private banking, though. If this is how well their credit cards work, I don’t want to try their wealth management products.