Since getting married earlier this month, we’ve been busy assembling a giant package of documentation for Rakhat’s US green card application. The insane complexity of an I-485 adjustment of status application is another article in and of itself (particularly given where we live), but we finally got the forms filled out, and all of the documentation and evidence assembled. So finally, with the application fully complete, I attached Form G-1450 on the top with my Capital One Venture X card details filled in. I felt pretty confident in doing this because I’d used the same card for our original I-129F application, and everything went through just fine. I even earned points for the transaction! We sent the application off on Monday.

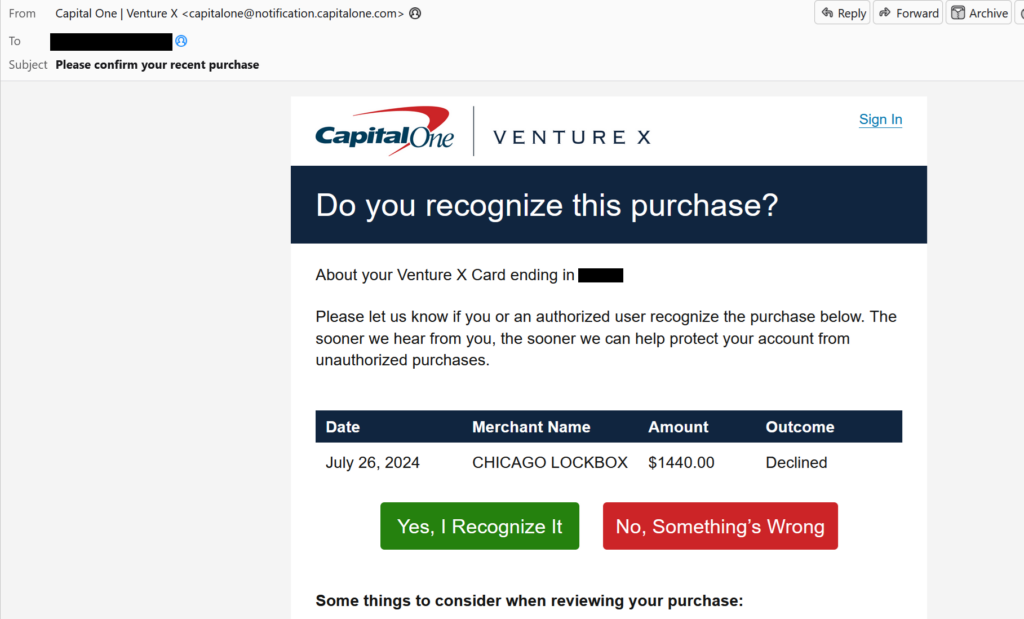

Yesterday afternoon, an email from Capital One rolled in: “Please confirm your recent purchase.” Uh-oh. I opened it up to see this:

Yes, I did recognize the purchase. It was the green card application fee. Why was it declined?

This is the most legitimate kind of charge possible. The kind that is basically never fraudulent. The charge was literally made by the federal government and there is essentially unlimited recourse against anyone making fraudulent payments to the government. Unless my account wasn’t in good standing, there would never be any legitimate reason to decline the charge. So, I thought maybe my autopay didn’t go through or something. Could it possibly be my fault?

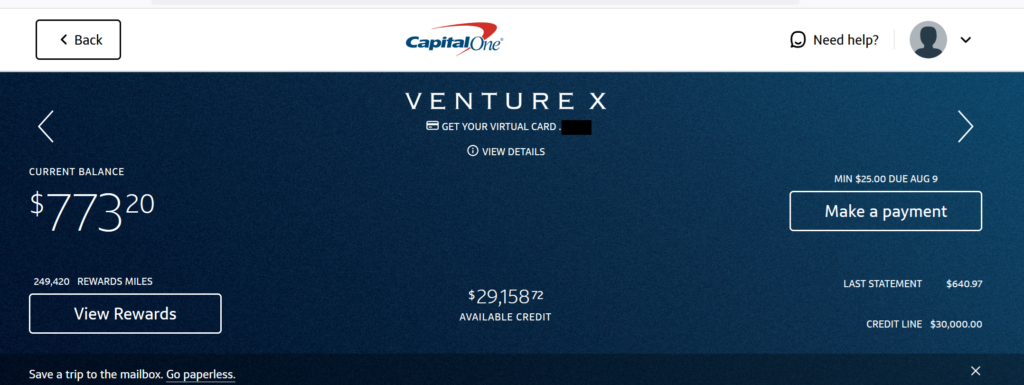

My account is current. I have over $29,000 in available credit. There’s nothing on my end that could possibly have caused this problem. However, Capital One laid off over 1,000 technology employees last year in a drive to replace them with AI. Don’t take it from me, you can read it on their own blog. So, as is increasingly common, Capital One has put dumb hallucinating AI bots in charge of important, serious things that have a very real impact on people’s lives. When this goes wrong, it goes spectacularly wrong.

The impact, of course, is significant. Immigration timelines are measured in months. We have to wait for our application to be returned, and file it all over again. Typically, this sort of unforced error will add 2 more months. In the meantime, Rakhat can’t leave the United States, and given where we live, this is a significant impact. There is only one flight a week to the US mainland. We don’t have a hospital, dentist or even a pharmacy here. It’s an extreme hardship that didn’t need to happen.

“Why did you trust Capital One?” some people will ask. “You should have sent a check!” Ironically, I made that decision to prevent fraud. Check fraud is rampant, and it’s a lot safer to use a credit card than to send a check in the mail these days. I won’t take the risk of a credit card transaction failing again, though, and will have to instead accept the risk of my checking account being drained by criminals.

In the meantime, should you trust Capital One for anything important or serious in your financial life–the kinds of things that absolutely, positively have to work? Given my experience, I cannot in good conscience recommend them. Their anti-fraud software product managers are bad at their job and should feel bad. Sure, use their card in retail situations where you can easily switch to another card if things go haywire. Their points program is exceptionally generous, and Capital One likely loses money on it. But don’t trust a Capital One card for anything that is truly important, and be sure to burn your points before they devalue.