I have been trying to figure out the best way to write about this because it’s so hard to believe it actually happened. I realize that what I’m about to describe is deeply personal, and I do try to keep the blog to topics that could impact other people. But the root cause of the situation that American Express created is one that could impact anyone, so I ultimately decided to share. If you’re wondering what all of this is about, pull up a chair because the story I’m about to share should give any American Express cardholder pause.

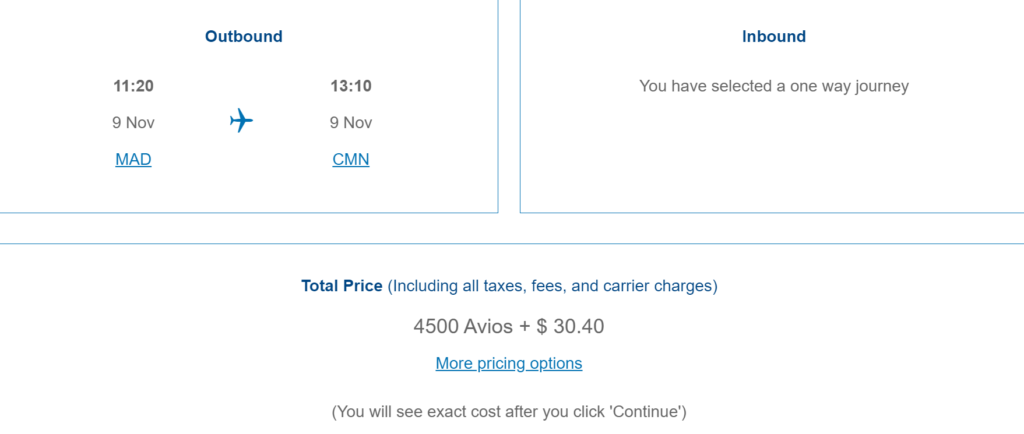

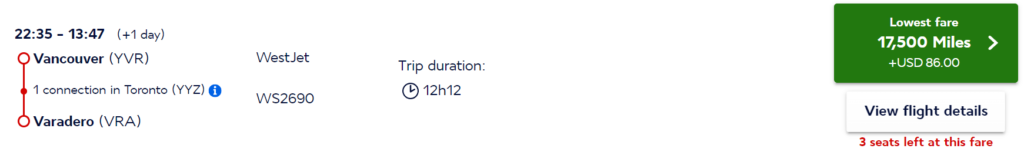

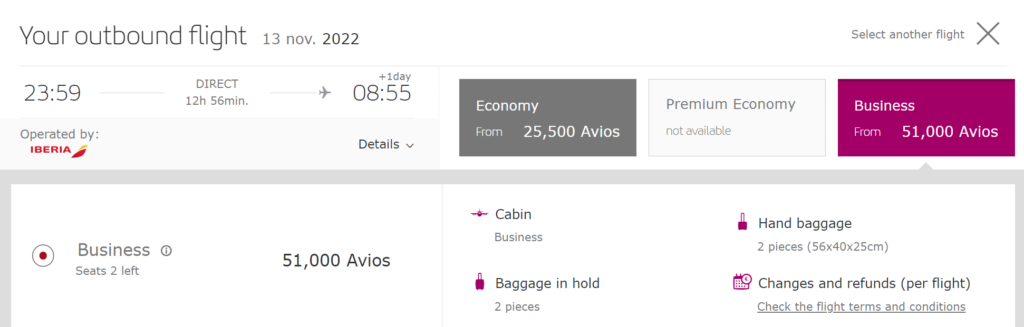

Last Monday was my wedding day. “Wait, what?” If you know me at all, let me assure you that I’m just as surprised as you are that I’m writing these words. However, what started as a friendship and then a fling grew into two years of talking to each other every day and traveling together to UNESCO World Heritage sites. Eventually, we decided we liked each other enough to file immigration paperwork, and after exploring my career opportunities in Kazakhstan vs. Rakhat’s career opportunities here (not as easy a decision as you’d think because Rakhat is a native Kazakh speaker who teaches English) we decided to try the US. Eventually the paperwork was approved, and Rakhat arrived. Via Qsuites, of course, and on the inaugural flight from Tashkent, because that’s how we roll.

Of course, the immigration process wasn’t smooth. We were planning to get married at a private gathering on Orcas Island, on a picture perfect balcony, with some of the most beautiful scenery in the Pacific Northwest as our backdrop. The US Consulate in Almaty had other plans. They use a contractor to process US visas and associated documentation, and the contractor failed to return an envelope full of documentation intended for Customs and Border Protection. When Rakhat showed up, he was paroled into the United States for 30 days while we sorted out the documentation problem with the US Consulate (fortunately, they admitted their error and FedExed the needed documentation). However, he wasn’t formally admitted to the United States at the time of arrival, meaning we couldn’t get married until he was. Otherwise, he’d be refused entry, returned to Kazakhstan, and we’d need to file a different form which takes another year to process. And if all of this sounds completely insane, welcome to the US immigration system.

Anyway, we decided to make lemonade from lemons. After all, we’d dated by traveling around the world together. Why not get married at Sea-Tac Airport? Rakhat would have to return there anyway to get formally stamped into the country, so we’d already be there. We arranged with US Customs and Border Protection to clear his paperwork on Canada Day, July 1st. And then I set about to turning our dream into a reality.

I reached out to a good friend, who is a Sea-Tac Airport volunteer. If you weren’t aware, airports have volunteer programs and airport volunteers are extremely well-connected. They’re allowed to go airside, they have relationships with airline staff, lounge staff, and other airport staff, and they are trusted liaisons. I shared my plans with my friend, who investigated options. We weren’t able to reserve the interfaith chapel at Sea-Tac Airport, because it’s operated on a drop-in basis. However, the American Express Lounge had a private room, and we were welcome to use it for the ceremony. We’d just have to ensure that everyone there met the requirements: a ticket valid for travel within 3 hours of our planned ceremony, and the ability to enter the Amex lounge (either via a qualifying American Express card or as a guest of a cardmember).

As it turned out, we’re part of a group of people who travel, and a lot of people had travel plans over the holiday week. Also, many people we knew from the private event we attended on Orcas Island were flying out that day as well. And we could return on a quick flight ourselves. Really, it was perfect. We happily agreed, our airport volunteer friend confirmed (and subsequently re-confirmed with 3 different people on 4 occasions) and we set the date and time: 6:00PM on July 1st.

On Monday, Rakhat got his stamp. We went to the airport a bit early, not knowing how long it would take, checked in for our flights, and changed into suits. We met our friends at the base of the elevator. And then, at 6pm, we all took the elevator up to the American Express lounge. We were nervous but excited, ready to realize the dream that we had both traveled tens of thousands of miles around the world in order to achieve.

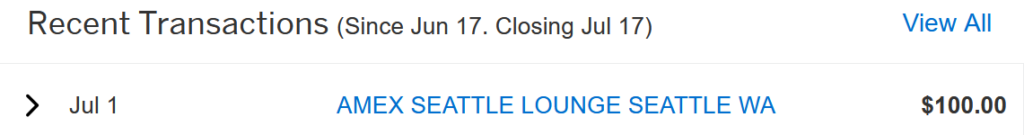

When I got to the front desk, I gave them my name, assuming they’d be expecting me. Nope. “We don’t have anything on the schedule,” the front desk agent said. I told them who approved it, and who had confirmed it, and the agent frowned. She went ahead and checked us in anyway, charged my American Express card $100 for two guests (Rakhat and Charlie, my best man) and seated our group at a table in the lounge while they sorted things out. I figured they’d get the room ready, invite us back in a bit, and we’d be able to have the ceremony.

After 15 minutes of standing around awkwardly, the agent came over and beckoned me into a corner. “May I have a word with you?” She proceeded to inform me that they didn’t have us on the schedule, and there was nobody to approve it because the manager went home sick, so we couldn’t have the room. Furthermore, a wedding ceremony in the lounge wasn’t consistent with the brand image of American Express, so she wouldn’t be able to approve it.

I was absolutely aghast. Wait, what?! Are you for real?! After setting it up, multiple confirmations, screen shots of text messages with approval from their boss, etc.? But the agent was firm. The brand image of American Express would be protected, and we wouldn’t be having our wedding in their lounge. OK, fine. I get it. Two guys who like to travel to places where American Express isn’t widely accepted probably don’t fit the brand image of American Express, and for that matter, I think American Express doesn’t fit my brand image either. I like my cards to actually work to make purchases, and you can barely even use them in Canada let alone anywhere further afield from the United States.

OK. I’m good at thinking on my feet. I went back to my wedding party and told them the news. “Let’s go on an expedition to find the chapel,” I said. “Maybe we can use that. We’re not welcome here.” So we all traipsed out of the lounge, down the elevator, down multiple escalators, and we found the Sea-Tac International Airport Interfaith Prayer And Meditation Room. A couple of airport employees were hanging out in there during their lunch break, but weren’t actually using the room and were happy for us to get married there. So, moving fast before someone showed up to kick us out, we crowded into the room and my friend Dawn officiated. The space and atmosphere was much better than a stuffy Amex lounge anyway. We didn’t have to worry about violating anyone’s brand image. We just got to enjoy a beautiful moment together. And our reception afterwards was in the Club at SEA, which happily let everyone in without judgement.