Chase pays some of the highest commissions in the blogosphere. It can be hundreds of dollars per card signup. The travel blogging community is overall pretty friendly, but nothing is played closer to the vest than highly coveted Chase affiliate links. Nothing can financially make or break a travel blogger faster than Chase either granting or revoking sponsorship. And that’s why you will hardly ever see anything negative written about Chase. All you ever hear is whispers, but word on the street is Chase doesn’t like criticism. They don’t ever want to see anything negative. So, if you know what’s good for you, and you don’t want to be blackballed by Chase, then you’d better stick to the talking points.

And that’s why Chase has probably been able to skate for so long on their absolute disaster of a travel portal. It’s a hot mess and after having spent over 3 hours of my Seychelles vacation banging my head against the wall in trying (and failing) to book a 40 minute roundtrip flight, I am mad as hell and I’m not gonna take it anymore! And I am writing it with the full realization that it might not even get read, while potentially costing me thousands of dollars in commissions.

Higher Prices

The Chase travel portal is operated by Expedia. You would think that this means that they offer the same prices as on expedia.com, but they don’t. The prices are usually higher on the Chase portal.

I’m answering a lot of questions from friends lately about flights to Beijing for DEF CON China, so I picked this route at random (but for different dates). This problem is so widespread that literally the first flight I looked at cost more. This example is for Seattle to Beijing, departing June 12th, returning June 19th.

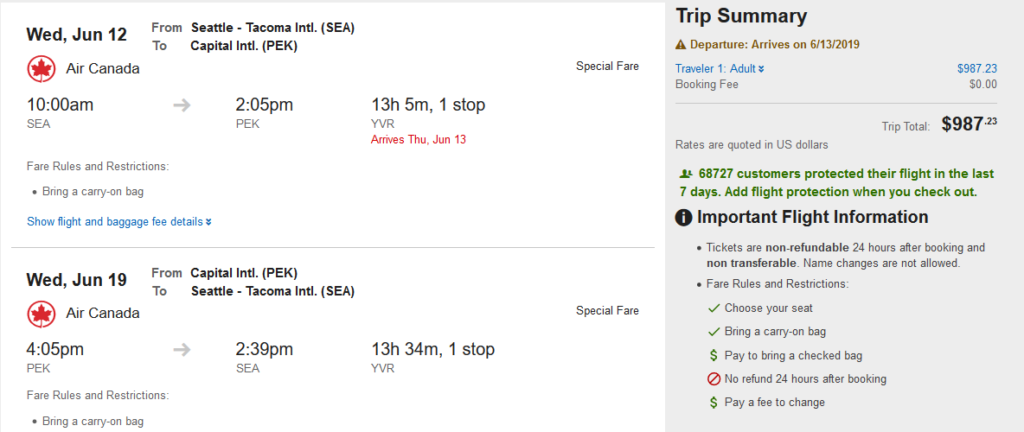

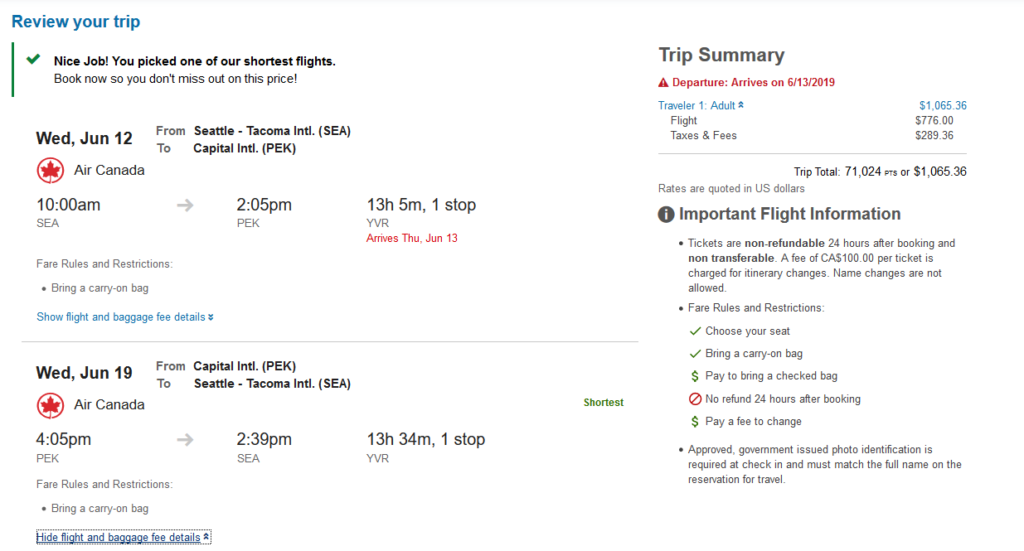

Let’s start with the price on Expedia:

Now let’s check the Chase portal:

The Chase portal price for the above example is $78 more. The flight I was looking at booking today (but failed to book) between Mahe Island and Praslin Island in the Seychelles was $168.60 booked through the Chase portal, but $151.07 booked directly though the airline. While domestic US flights are generally priced about the same as the Expedia price, international flights, in my experience, tend to run about 10% more. This sucks a significant part of the value out of the points you have earned.

It’s not just flights that are more expensive when booked through the Chase portal. Rental cars can be significantly more expensive. Hotels are also often more expensive.

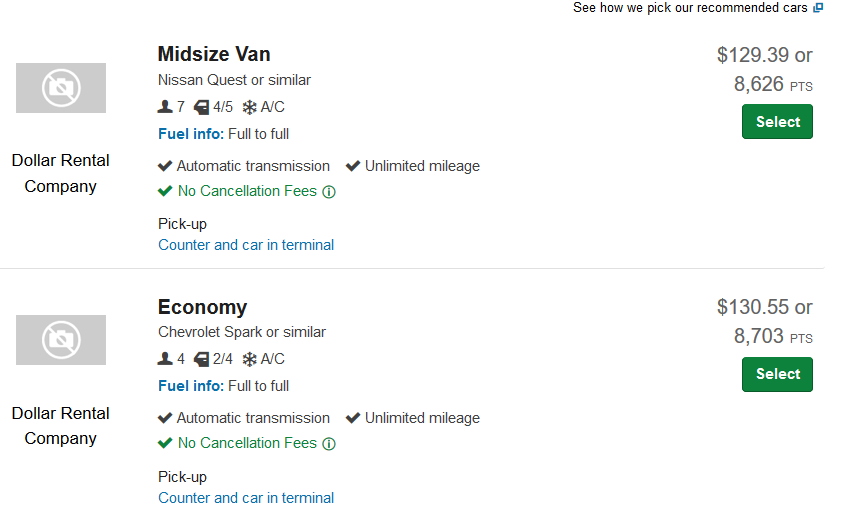

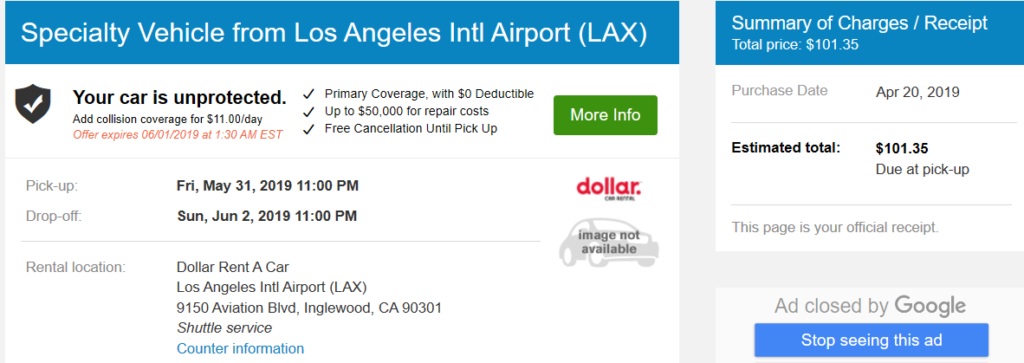

To underscore this, I’ll use a trip I’m taking in a few weeks as another example. Here’s the current best rate available through the Chase portal for a car from Dollar Rent A Car:

Here’s the deal for a “specialty vehicle” (which will probably be a minivan) that I locked in on Priceline. At the time I booked this, cross-checking with Chase yielded an even higher price than is currently offered:

Chase jacks up the rate by almost 30%. If you have the Chase Sapphire Preferred, spending your points this way versus just going for a statement credit at 1 cent per point actually costs you money.

Not All Flights Are Bookable, Even When They Appear On The Portal:

OK, so you’ve decided that you’ll let Chase overcharge you for a flight so you can at least spend the points, while getting 10% less value than you expected. NOPE! The site is rife with technical glitches. Here’s what happened when I tried to buy a flight from Mahe Island to Praslin Island in The Seychelles. The flight appears on the Chase portal. It shows up on Expedia, too. Air Seychelles isn’t some sort of budget carrier or third-tier airline; it’s part-owned by Etihad and uses Etihad Guest as its frequent flier program. It’s the primary airline in a popular (and high-end) holiday desination. While it was $17.53 more to book with the Chase portal, I decided that I’d overlook it.

Ha! Just kidding! I’d select my flights, put in all of my information, get all the way through to the end, and then the following error message would appear:

That leads to the next problem, which is…

Chase Travel Customer Service Is Terrible

The agents at Chase Travel (which is really Expedia) basically just use the Web site for you. If you have an error on the site, they’ll have the exact same error. They’re unable to deal with any situations that don’t fit the script. And they are on a very strict call timer with every incentive to get you out of their queue as quickly as possible. You are a hot potato, and all they want to do is get you out of their hands.

My first call had no resolution, so I became a hot potato. Chase Travel bounced me over to the bank. Call handling metrics good! The Chase agent was patient and helpful (they’re pretty good on the banking side), looked up my account, and verified that there were no issues that would prevent me from using my account. She transferred me back to Chase Travel. Call handling time minimized! The agent, after spending 3 minutes trying to convince me to “just wait a few hours and try again” had the same problem, and transferred me to something called the “legacy team.” Out of their queue! The “legacy team” agent took my information, we got all the way to the end, and….

…the call dropped. At this point I was into this for close to 2 hours, and I didn’t want to spend any more time on the problem, especially since the Internet connection (which slows down later in the morning–limited bandwidth on the island) was getting really choppy.

I tried again the next day. Another agent had the same problem, and tried to transfer me to the “legacy department.” After a few minutes, she came back on the line and asked me for permission to blind transfer me. I called her on it, but she blind transferred me anyway–into a queue of agents in The Philippines, which wasn’t the correct department. This was now my third agent in the same department (“New Platform”) who ran into the exact same problem. Mind you, I’m giving my name, flight numbers, and listening to disclaimers about non-refundable tickets each of these times. Finally, the Filipino agent got someone in the “legacy department” to have a try, and that agent couldn’t fix the problem either. So, in the end, hours into the problem, the agent offered a creative solution: I could book directly with the airline, and get reimbursed at 1 cent per point.

Yes, because Chase is incapable of selling me a flight, I should apparently lose the 50% bonus–which, I’ll note, I pay a $450 annual fee to receive. Ultimately, the agent gave me a 5,000 point “courtesy credit” but this is now on my record. Chase has a history of “firing” customers it thinks are costing them too much and I have now poked the dragon.

Wrap-Up

It’s not a secret that the new Chase travel portal is terrible. It’s terrible, horrible, no good and very bad. But you’re only going to read about the problems with it here.

I ultimately don’t think that Chase being so thin-skinned helps them. They’re positioning the Chase Sapphire Reserve up against the American Express Platinum card, a truly premium card from a company with a lot of experience offering one and the global infrastructure (including a worldwide network of local offices) to match. Chase has third-party agents in Manila working “on behalf of” Expedia, a partner who may have been selected because they pay the highest rebates. And those third-party agents have only one mandate: get you off the phone, as quickly as possible. This isn’t the service I expect from a credit card with a $450 annual fee. If I want to spend the points I go out of my way to earn by putting a Chase card at the top of my wallet, I want it to “just work” as advertised. And I also don’t want to play shell games with disappearing partners, devaluing points and deceptive pricing. Chase, if you’re reading this–listen, I have a lot of respect for you guys. You’re brilliant at marketing. But the product ultimately has to measure up, and right now, it isn’t measuring up. Given the increased churn I expect this issue to cause, you’re about to get kicked in the NPV of your LTV.

For what it’s worth I wrote that their move to Expedia for their back end would be terrible while everyone else was focusing on the press release benefits of more hotels on offer.

Meanwhile I suspect it gets less criticism because many of us find the best use of Chase points is transfers to airline partners (and Hyatt) rather than using points to pay directly for travel. Most bloggers do not have Chase affiliate links, after all!

Chase has never, ever expressed concern to me over criticisms I’ve made, in fact it would surprise me to learn if card issuers were doing this because if they were seen as directly influencing content they’d become responsible for that -content in the eyes of regulators, which I think they’d want to avoid. Perhaps I’m simply unaware of what you suggest is happening.

I used to agree that transferring points to airlines was a better option. However:

– United: Delta’ed their award chart. Unless you’re burning points on partners now (which was never a really great deal), it’s not looking like good news.

– Flying Blue: 110k points in economy one way SEA-CDG this summer. Thanks but no thanks.

– BA: Bad deal on long haul, and now a bad deal on short haul too. Booked in advance, Delta and Southwest are better.

– Iberia: Can be a good deal if you can live with the restrictions of no changes anywhere anytime ever.

– Southwest: 1.5 cents per point. Same as spending through the portal.

– jetBlue: Less than 1.5 cents per point so, uh, why?

– Virgin: A couple of sweet spots left, for 5 minutes or so until they devalue. Still, the best are tough to use because roundtrip booking is required.

– Hyatt: This is Seat 31B. I’m staying in a guest house in the Seychelles with a fan and a mosquito net. The Kempinski is down the street and yes, I do very much enjoy the public beach in front of it. 🙂

Am I missing anything? Oh yes, Korean, which was the best transfer option for outsize value, and which Chase lost as a partner.

Now maybe it’s true that you haven’t heard any of the same rumors I have. And maybe they’re just rumors. I’m sure Chase sends only the warmest fuzziest messages to bloggers with affiliate links who write anything negative. But if this is the case, why am I the only one calling Chase out?

I had high hopes for the Expedia transition. After all, they offer pretty good pricing through their subsidiary cheaptickets.com. And it was hard to do much worse than Connexions Loyalty, which was really only ever good for rental cars (they often had amazing deals). Those hopes have been crushed, and the transition has been a disaster.

1) premium cabin Air France, much better availability through their own program than partners

2) premium cabin Singapore, much better availability through their own program than partners

3) united premium cabin partner awards haven’t yet been hidden-award-charted

4) hyatt, not for you, but very much up my alley — I simply laid out why *I* value transfers more than giving up and just taking 1.5cents/point in value.

5) BA for intra-Asia and Qantas short haul business class

Yes I miss Korean (but i transferred a bunch before the end).

And what about all the properties that the Chase Rewards website shows when you looking for lodging, that can’t be booked? What’s that about?

And I agree, the travel customer service is subpar.

I’m guessing that happens for the same reason it happens on Expedia, Travelocity, Booking.com, etc. — because the OTAs get only so many rooms, and when those (one or two) are gone, it’s “Sorry, we’re all sold out!” (NOTE: Not “the hotel is sold out,” but rather “WE are sold out.”)

I’ve been looking at hotels in Tokyo through the portal, where “We’re all sold out!” … but the actual hotels have plenty of space left.

I absolute hate Chase Travel! Traveling with a family of 10 they cancelled my flights, I never got an email and luckily I checked up on my flights before booking my very expensive villa to find out they cancelled my flight. I will NEVER book through them again.

Step 1: Just yell at them and demand to be escalated to a Supervisor. They won’t take it personally.

Step 2. Wait on hold for an hour while the supervisor calls the airline and negotiates for you.

Step 3. Take whatever option they give you, because it’s your only option.

Try booking a rental car in Morocco. Nothing, zero, shows up. Go to the “regular” Expedia site and a dozen options show up.

BTW, a few years ago a blogger told me that chase did indeed indicate displeasure at criticism and warn that affiliate links can end if the criticism didn’t.

I had the same experience with rental cars in Colombo. It seems that Expedia is filtering/limiting the selection to commissionable rates, with the commission (presumably) rebated to Chase.

Same problem in Ireland. It is ridiculous. They just don’t want to pay the fee.

Chase Travel’s switch to Expedia has been terrible. They need to reverse that decision.

I have booked 25 hotels thru their travel

portal. 3/4 were priced the same as the Expedia website, the rest the same as the hotel websites or cheaper than all the above. I like their occasional 10% UR premium bonuses on bookings. I think your issues are mainly with flight bookings. I’ll take 4S, 21c, & boutique props at a 33% discount any day.

Expedia is using a secondary platform and drop out agents to man their customer service. Availability is poor, pricing uneven and customer service non existent. It is not what you expect from a “premium card” contractor.

Personally I never use Chase’s travel portal because the prices always seem to be higher then Expedia/ Orbitz just like the author mentioned and thanks to United Airlines devolution Ultimate Rewards points are going to have far less value for me at least

Expedia and Orbitz have cheaper rental car deals then booking direct and I just received a 15% cash back using Ebates for a car rental on Orbitz.

Also I fly Copa now and found the exact same prices those 2 sites then booking directly from that airline.

Orbitz Visa: 2% back on purchases ( 7% in Orbitz dinning program, USA only:-(. )

6% back on flights, 10% back on hotels, Remember to combine these with travel portals.

As an budget traveler that spends most of my time in Brazil I get little value from most hotel loyalty programs mainly do to their limitated footprint.

Domesticilly Best Western offers great rates to military veterans combined with Ebates or Top Cash back travel portals.

Expedia/ Orbitz negatives: As mentioned if you do better if you can stay loyal to one hotel brand in the USA, especially Hilton or Marriott and use their co-branded credit cards.

Chase travel portal is awful!!!! They jack up the price of my flight every time I try to book to redeem some miles! Every. Single. Time. There’s no point in using miles if chase is going to make my flight price more expensive. I’m beyond frustrated with them.

Chase Travel and reward call center the Worst I have seen so far.. First and last experience ever.

Is anyone having problems getting points back form Covid-19 cancelled flights.

I followed procedures per their site, and am getting a run around between them and TAP?

thanks

YES! It is HORRIBLE. First, escalate to a supervisor. Tell you want the amount of your credit to be used for the airfare you are seeing directly on their site, or you will file a complaint with the FTC for fraud. It’s basically bait & switch when they advertise flights on their “portal” but those flights are unavailable to you because you are using a credit. An operator at American Airlines told me it’s because they loose money when flights are cancelled and then rebooked, so they are trying to recoop it.

I have chase travel credit due to Covid-19 and I’ve been on the phone with them because I want to book a flight with my travel credit. They are trying to extort more money out of my pocket first by saying:

my original itinerary ticket doesn’t match the boarding letter of my new flight for air canada, so instead of looking to pay $200 flight ticket, I have to pay $700 to match the boarding letter.

The next day I called back:

taxes are due, so I have to pay $50 more.

I called air canada and they said chase is being ridiculous and that none of the above is true for them and I have to use my travel credit with chase to book the ticket.

Call #4 of trying to book my flight now using my ticket:

On the air canada website the ticket says it’s $200, on their end it’s $250.

I don’t know why chase travel customer service is so crap. I paid $450/year for my reserve card and they’re just sucking in my time and money. Going to cancel their card before the annual fee shows up.

I’m going to try again tomorrow. Why is Chase Travel trying to extort money from me? I have a travel credit I want to use, my name and travel destination is all the same and this shouldn’t be a problem, but is it to them. I am getting fed up.

Air Canada is probably listing a Web special fare that is only sold directly and isn’t available from online travel agents. That’s why you’re seeing a price differential.

Usually I can get the same deal with Chase for US domestic airfare as I can from the airlines, but foreign itineraries are a crapshoot: sometimes lower and sometimes higher.

The difference in the price of the fare is because you’re flying a differnet day – unless they cancelled your flight (not the other way around) and you took a rescheduled itinerary instead of a refund, the airline doesn’t owe you a new flight at the same price.

Tprophet- I wanted a refund, but chase travel only can give me a travel credit back in March when cases of Covid-19 was spiking. I’m using the same web system as them and I want to match the dollar amount I currently see on the computer screen on the flight I want to get on and their excuses always resorts to wanting more money out of me. All I want to do is use my existing airline credit and using that against the ticket I want to purchase. I know I’ll have to pay the differences if the ticket price is higher than my credit which I’m willing to do. However, for chase travel customer reps telling me I have to pay extra money because boarding number doesn’t match or taxes are owe or trying to come with some silly excuses for me to pay using my travel credit is ridiculously a tactic they’re trying to extort money from me.

Eventually I kept calling and talked to reps after reps. I just got off the phone with a rep who I spoke to two hours and finally it looked like I got my case resolved. I haven’t gotten anything in my email, but I did get a record locator (hopefully that means something). She said I’ll receive my flight details within 48 hours.

I am not going to fall in the chase travel’s trap of them trying to profit money off of me. Especially during these tough times. We’re in a pandemic and I can’t believe they’re doing such thing when unemployment rate is so high. I’m glad this site exists and more people can come across this and see what chase travel does is such a scam. Don’t give up and lose patience. Work through it and be on the phone for two hours if needed. If I can do it for two hours, so can you. Another thing is to record them. I recorded my conversation with them. I thought I needed to get myself a lawyer and sue them for extortion. If there’s a business that’s conducting a scam, report and write about them. It’s good so other people will take notice. I’m not here to scare you guys using chase travel, but think twice if you ever want to cancel your travel with them because most likely, they’re not going to reimburse you for how you original paid (my case), they’re going to give you a credit and next time when you call to use that credit, just be careful and don’t fall for any of their tricks when they want to extort more money from you for booking a flight. If there’s a price difference, it’s understandably to pay that difference, but for something bogus, fight it!

I agree completely! I have been on the phone for 2.5 hours now, have had two calls mysteriously drop and the only option is a travel credit with an airline I won’t use. It is beyond frustrating and I will probably cancel my card as well when the renewal comes up.

these droped calls are not allways an accident………..the agent does not want to work, so the AGENT drops the call………

You are so right, I am a Chase Private Client and love, love, love my financial advisor, but I gave up on Sapphire Reserve due to Ultimate Rewards, which are anything but ultimate. I was in Spain trying to book a Delta flight in the US for the next month. I selected the flights I wanted and submitted the purchase, not giving it a second thought. In the morning I checked my email and I was booked on the wrong flights and even the wrong days of travel! I made long distance calls to UR which kept me on the phone for 35 minutes, while telling me that the flights I wanted weren’t available. So I called Delta in Atlanta and they were amazing, first of all the flights and days were available and since I am Platinum Medallion, they booked me, but had to charge me a $50 fee, since it was not originally booked with them, which I gladly paid because the flights were for Christmas with family! When I got back I tried with UR to get some relief for the $200 in phone calls, because, of course, the call dropped 3 times and UR disconnected me twice and the $50 fee from Delta and it was crickets all around even though I threatened to pull my money from Chase. I then contacted my FA as she formerly worked with the credit card division. She got ALL the fees returned to me! I then demoted my Sapphire to regular, you can do it by calling them and forcing the issue, because I didn’t want to pay the fee for a card I don’t ever plan on using again unless they dump Expedia. So I have a Sapphire with $50K+ credit and haven’t used it in a year. Avoid this scam at all costs, it will cost you more than booking directly with airline, hotel or car rental, as the gentleman in 31B said!

I’d like to add to this in 2021:

I booked a flight with Chase UR (using points + cash) to Ireland. I received my ticket confirmation from UR ($229.46 and 37,928 PTS), chose my seats on American with the AA app, and that was that.

A few days later I needed to change the flight. The “Virtual Agent” online hiccupped at the payment point (there was a price difference of +$180), and I had to call the UR “Travel Center”. I had to listen to a preamble, then choose 1, then listen to more preamble, then choose 4, then I got transferred: exact same auto-attendant, preamble again, then 1 again, then more preamble, then 4 again, then transfer: new menu, chose 3 (I think) then….honestly it went on about 5 layers before I was finally on HOLD for about an hour. The agent I spoke with was clearly overseas with a TERRIBLE VoIP connection that kept clipping his voice out. Eventually he transferred me back to someone in the US who did take care of things. I paid the extra $180, received a confirmation email, chose my seats with the AA app again, and thought I was done and put it down to bad luck.

A few days later I show up at the airport and AA tell me the ticket hasn’t been “ticketed” properly and that I have to pay the full price of $869 or they can’t check me in. I tried calling UR, went through the menu tree again, eventually reached an agent after about 25 mins wait, she transferred me to another agent who said, “Here is your AA locator number. Is there anything else I can help you with?” WHAT?!!! At that stage there wasn’t enough time left. The AA check-in agent had told me I had until a specific time to get back to the check-in desk to get the ticket issued or I wouldn’t be able to board. Bear in mind I’m dealing with Covid test result documentation and other stressors (my mother in Ireland had a stroke and I’m trying to get back to see her). So I had to give up on UR and pay AA directly at the airport. I paid AA directly and boarded the flight.

I later needed to change the return flight from Ireland (given my mother’s condition, and having to deal with nursing home care, finances, power-of-attorney, etc.). Chase UR could no longer help me as AA now “owned” the ticket. Mind you, it had the same locator number.

I won’t get into how awful the wait times were for American Airlines either (184 mins, 65 mins, 155 mins), the whole thing was a bloody nightmare.

NEVER, EVER, EVER AGAIN!

DO NOT USE CHASE ULTIMATE REWARDS TRAVEL SERVICE!!!

2021 MAY EXPERIENCE – THEY STILL HAVE THEE WORST CUSTOMER SERVICE AT CHASE TRAVEL….I recently booked a trip to Taipei, Taiwan using my points. Unfortunately, due to the pandemic, Cathay Pacific was consolidating their flights. In doing so, they moved the dates of my TO flight twice and changed my RETURN flight once. That’s no one’s fault so I can’t blame them. What I can blame them for is that Chase only sent me notice of ONE of the changes above. I found out about all the other changes from Cathay Pacific! When I called Chase Travel, which their customer support is based in the Philippines (nothing against the country or the people), they weren’t motivated to help. I asked the service rep to confirm my flights and she was still telling me original daes (not the updated dates). I had to tell them that they were wrong. I waited on hold for 10 mins for them to tell me I was right. She asked me if they could help with anything else and I told her, “I have no confidence in you that you are able to help me any further.” She was shocked but I was just as shocked at their shitty customer service.

Cut to my return flight. Again due to the pandemic, I was not able to make my flight. Long story short, Taiwan requires a negative covid test result 72 hrs before your departure flight (not including weekends). I got my test on Friday for my Tuesday flight so I was good. I got to the airport and the lady at the counter told me my test was expired. She explained that the US requires a negative covid test 3 days before your departure date (including weekends). As a result, I was not able to fly. Again, no one’s fault = pandemic. I contacted Chase Travel Support to rebook my flight and she said that I was a no show which I wasn’t I explained the whole situation and she spoke with her manager who said that they can get me credit for another flight. When I asked her how much credit I was given, she told me that I would have to call back and book a flight to find the credit amount…WHAT????? I told her that I was agreeing to receive a credit for an ambiguous amount??? As she was finalizing everything, she then told me that she couldn’t process it anymore because there was an error in the system. She said she would log a ticket internally and have the next shift contact Cathay Pacific because their airline was closed. She told me I would get a response within 24-48 hours. That was 5/25 and it’s now 6/8…crickets. Also, I called Cathay Pacific directly afterwards to see what they could do and they told me that Chase was incorrect; they could’ve rescheduled me or given me a credit. The key point is that they were still open-not closed!!! Thee absolute worst!!!! This whole ordeal which got me no where took 55 mins!!!

I have a very negative experience with Chase Travel Portal, it’s customer service, and Chase Sapphire Preferred customer service when trying to book a flight in Business in January 2022.

The consistent problem is that a lower price comes up on the initial search. After flights are picked price jumps by $1000+.Over the last three days, this has been consistent. The customer service line from Chase Travel is “dynamic pricing. ” Which can happen, but for almost 72 hours, this consistent yo-yo pricing is either a glitch, or a illegal “bait and switch” pricing!

I understand that Expedia provides pricing info to Chase Travel.

So today I checked both the sites at approximately the same time (10:20 pm +/-) and found an even larger difference.

Anomaly, or Bait and Switch? You be the judge!

PHL-CCU-PHL Business United/Vistara Jan4 – Jan 26 Expedia Price $2627.87

PHL-CCU-PHL Business Vistara/United Jan4 – Jan 26 Chase Travel Price $4666.18

Both priced around same time Jul 9, 10:20 pm

Expedia is the pricing provider to Chase Travel Portal

Does anyone know of a benign cause for this?

Have anyone else had a similar experience?

Thanks in advance,

Satya

The service at Chase Travel is indeed terrible: I recently called Chase Travel to cancel my rental car reservation and flight tickets, and Chase confirmed that they were cancelled and promised to refund full Ultimate Rewards points to my account. Three weeks later and after numerous calls, I still did not see my refunds. Every time I call Chase Travel, I was told refund request was submitted by the representative I was speaking with and asked me to wait for one week. One week later, nothing happens. I ask for email confirmation and never receive the email as promised. Anyone else has had same experience? I do not know what to do except filing a lawsuit.

Similar experience and I get the same song and dance about waiting one week. Have spent literally hours trying to get $600 credited back to my account and nothing for 13 months. I wonder if the Better Business Bureau would have any success.

Is there any time you can call chase ultimate rewards travel and get a US based agent?

I will literally ask a question of the Filipino crew and get an answer that has absolutely 100% nothing to do with what I asked. and that happens 3 time in a row. and when I tell them “that’s not what I asked” I get sorry and another useless answer.

I feel totally hoodwinked by chase!

What a nightmare trying to book flight with flight credit with them! Despite having 1150 in credit end up paying 100 dollars more for a 700$ flight. Incompetent and outright fraud!

I booked an internation flight for next friday with a $1,000 voucher and have yet to get the ticket or confirmation on an INTERNATIONAL FLIGHT>….Overseas customer service is really bad,,,,,,,,,,,if something goes bad like my flight,,,,,,,,,,,,,,they do not even contact you!!………….I will never use them again………They also need to learn how to speak ENGLISH

Recieved TERRIBLE customer service from Chase ultimate rewards travel service! You can expect to be on the phone for a minimum of 2 hours for a simple transaction…. That’s if they get it right the first time! I lodged a complaint with corporate but they don’t seem to care

Chase travel is a scam. I booked a Lufthansa trip to Germany for $5,048 round trip business class. the chase price for the same flight was $9229.47. Not cool chase!

I took over a half hour to cancel a refundable flight booked via Chase (no way to do it online on their website). Got transferred twice and asked the same security questions three times. Two days later I am still waiting for the ticket refund to appear on my charge cards. Very unknowledgeable service reps.

I can’t stress enough how incredibly ineffectual and idiotic the Chase Travel Department is. They really need to be shut down and fast. They are the bane of my existence. My heart rate increases every time I have to call the 855 # as I know what level of ineptitude I have to look forward to with every agent. I’ve take to hanging up and calling back three or four times to try to find someone who understands basic travel transactions. My NY resolution is to NEVER use their travel service ever again. Much easier to apply points to reduce your monthly bill.

Here’s my sad, unresolved Chase travel nightmare. Bought a ticket using points and money to Cabo for March 2019 – Covid – and cancelled flight for flight credit. Rebooked flight to Cabo through Chase Travel using credits for flight to Cabo in March 2022. We attempt to check in online and my husband is able to, but I need to go to agent at airport. Turns out that Chase has booked and paid for husband’s ticket, but they reserved but never booked my ticket. So it’s Spring Break and my only option is to buy the only remaining ticket for our flight at the counter. The airline counter agent can see Chase’s error in her system. So I call Chase as soon as I get through security, and again from Cabo, and 4+ times since I returned home. Every time I’m told by a supervisor that they will credit me the full price of the ticket in points in a few days, but they can’t email me to confirm the resolution. Now here I am 13 months later and still nothing. I will NEVER use Chase Travel again! I cannot believe that Chase Visa allows Chase Travel to continue with this crappy service. Any ideas? This is not the airline’s fault.

Like most here I’ve had HORRIBLE experienceS with Chase UR. For all the benefits they claim (in lieu of $500+ annual fees) is extremely unsatisfactory.

I had to make cancellations to some international flight tickets I had booked on their portal because of death in the family. Mind you that these were refundable tickets and most airlines have bereavement policies in place. Now despite showing them proof of the death, my relation and spending by now 5+ hours over the phone with them, I am waiting for the appropriate refund to show up. It has been on average 3 months since I made the cancellations. For one of those flight tickets on Qatar Airways, they straight up quoted a $300+ cancellation fee (despite death in the family), when the fee listed on Qatar’s website was under $150.. I am still waiting on that refund to show up – a potential value of $2000..

I am breaking my head over this and despite spending so many hours with customer service over the phone, there has been no resolution. Absolutely ridiculous.

After using Chase travel portal several times I quit and will never use it again. They can’t handle the simplest tasks: I had to change a flight, which incurred an extra $212 cost, and Chase could not give me a receipt for that change! They could only show me the cost on my credit card statement. What that means is that I have no receipt for reimbursement from my client and will have to eat the cost of the flight change! Ridiculous. I also arrived at a hotel to be told they were overbooked and I was not going to be able to stay there! They told me it was because my reservation was through Expedia, which put me at the bottom of their priorities. Calling Chase helped in no way – they couldn’t even help me find a nearby hotel – the person on the phone sounded like she didn’t give a crap.